The Bretton Woods Agreement: Origins, Development, and the End of the Gold-Dollar Standard

The Bretton Woods Agreement represents one of the fundamental pillars of the postwar international economic system. Signed in 1944, it established a framework for global monetary stability by pegging currencies to the US dollar, which in turn was tied to gold. This article explores the origins of the agreement, the historical context that led to its creation, and the dynamics that led to its abandonment in 1971, marking the end of the gold standard era.

The Origins of the Agreement: From Postwar Chaos to the 1944

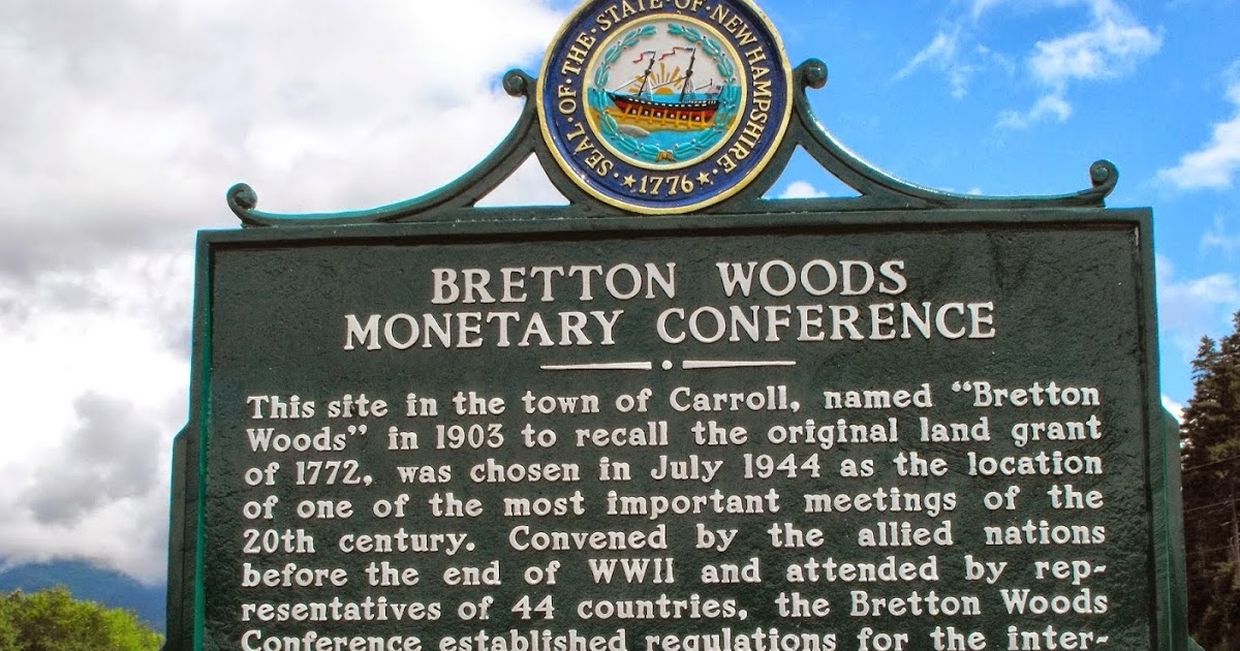

Conference The roots of the Bretton Woods Agreement lie in the lessons learned from the Great Depression and World War II. In the 1930s, the world was engulfed by economic instability: competitive devaluations, trade restrictions, and protectionist barriers had exacerbated the global crisis.The classical gold standard, in place until World War I, collapsed under the weight of economic imbalances and wars, leading to a period of uncontrolled monetary fluctuations between 1919 and 1925, followed by a brief return to the gold exchange standard from 1926 to 1931, and finally a managed floating rate until 1939.In the context of the war, the Allies recognized the need for a new economic order to prevent future instability.In 1941, the United States and the United Kingdom began discussing plans for a postwar system.The American plan, spearheaded by Treasury Secretary Henry Morgenthau Jr. and economist Harry Dexter White, proposed an international stabilization fund and a reconstruction bank. At the same time, British economist John Maynard Keynes advanced ideas for an international clearing union. These proposals culminated in the Bretton Woods Conference, held from July 1 to 22, 1944, in Bretton Woods, New Hampshire.730 delegates from 44 Allied countries attended, with the goal of creating a stable monetary system to foster reconstruction and global trade.The final agreement established two key institutions: the International Monetary Fund (IMF) to supervise exchange rates and provide short-term loans, and the World Bank (then the International Bank for Reconstruction and Development) to finance long-term reconstruction projects.The system was based on fixed but adjustable exchange rates: currencies were pegged to the dollar within a 1% band, and the dollar was convertible into gold at $35 an ounce.This reflected the economic dominance of the United States, which held the majority of the world's gold reserves at the time.

How the Bretton Woods System Worked

Launched in 1947, after ratification, the Bretton Woods system transformed the global economy into a gold-dollar standard.Nations pledged to maintain parity between their currencies and the dollar, intervening in currency markets as necessary. The dollar, as the primary reserve currency, was the only one directly pegged to gold, making the system a hybrid of the gold standard and the dollar standard.This framework fostered postwar economic growth, supporting the Marshall Plan and European reconstruction. In the 1950s and 1960s, it promoted stability and international trade, complemented by the General Agreement on Tariffs and Trade (GATT) to reduce trade barriers.However, internal tensions emerged as the global economy evolved. The US began printing more dollars to finance budget deficits, wars (such as Vietnam), and social programs, leading to a glut of dollars abroad—the so-called "Triffin dilemma," which predicted that issuing reserve currency would undermine confidence in the system.

Causes of the Collapse and the Abandonment of Gold as a Store of Value

The Bretton Woods system lasted about three decades, but by the 1960s, cracks became apparent. Inflation in the US, combined with growing trade deficits, led foreign countries to doubt the convertibility of the dollar into gold. European central banks, such as those of France and Germany, began converting dollars into gold, draining the US reserves of Fort Knox.The crisis culminated in 1971. On August 15, President Richard Nixon announced the suspension of the dollar's convertibility into gold,known as the "Nixon Shock."This move, motivated by inflationary pressures and an outflow of gold, ended the Bretton Woods system and the gold standard. Currencies moved to a free-floating regime, with the dollar retaining its role as the reserve currency thanks to US economic strength, but no longer pegged to gold. The abandonment of gold as a store of value pegged to the dollar marked the beginning of the era of fiat currencies, based on trust in governments rather than physical assets. This shift allowed for greater monetary flexibility but introduced risks of instability, such as inflation and currency crises, which became evident in subsequent years.

Conclusion: The Legacy of Bretton Woods

Eighty years later, the Bretton Woods Agreement remains a model of international cooperation, having laid the foundation for institutions like the IMF and the World Bank, which continue to operate.Its collapse highlighted the limitations of fixed systems in a dynamic world, leading to the current system of floating rates. Today, with debates over cryptocurrencies and digital currencies, the lessons of Bretton Woods are more relevant than ever, reminding us of the importance of adaptability and trust in the global monetary system.

Thank you for reading. Share this article with your network!